Your Go-To Solution for Effortless Crypto-Tax Preparation

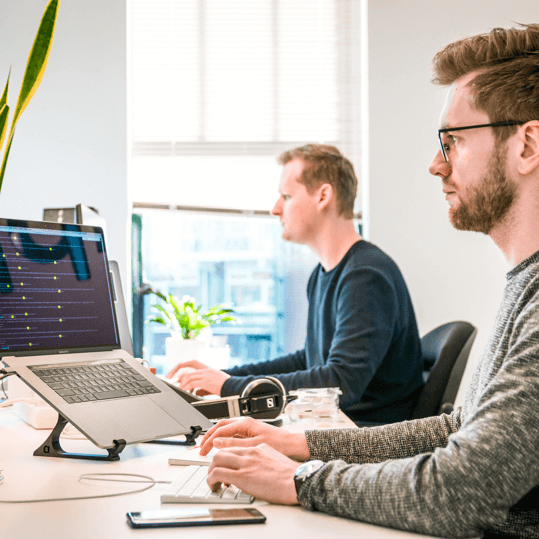

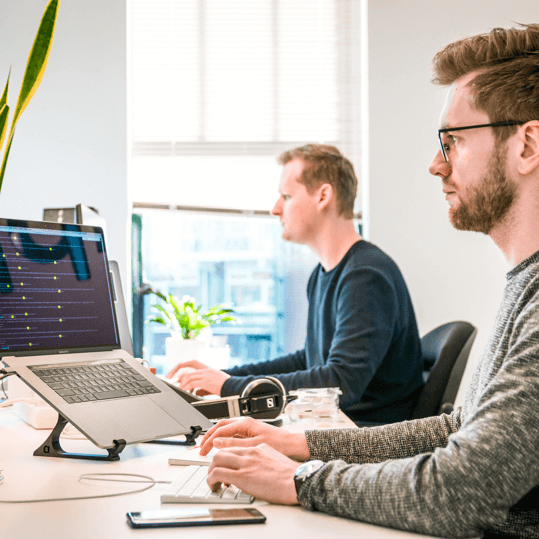

Crypto Tax Prep Has Never Been Easier

We serve individuals and businesses that need help navigating their cryptocurrency transactions.

We offer a tailored platform that simplifies the process of preparing and managing crypto-related tax obligations.

Explore how we streamline and simplify crypto-tax complexities, offering you the peace of mind that your tax forms are meticulously handled and reviewed so you can focus on the things you love.

Info Gathering Time

Begin by gathering all your cryptocurrency transaction documents, like records from your wallets, exchanges, and any other platforms where you’ve conducted cryptocurrency transactions.

We’re Here for You – All Wallets, Exchanges & Chains, Including NFTs!

Send Us Your Documents

Our platform is versatile, capable of handling various file types and formats, making it easy for us to process your data, no matter how it’s stored. Simply send us your documents to our secure and privacy protected platform.

We're Ready for Tax Time: Reconcile and Prep

Once we have your documents, our expert team takes care of everything.

We’ll handle the reconciliation of your crypto transactions and complete your tax forms, including the essential Form 8949 and Schedule 1 (Form 1040) required for reporting your cryptocurrency activities to the IRS.

Our experienced team is well-versed in managing various transaction types, so you can trust that all your activities will be accurately and easily represented.

Share Your Tax Reports with a Hint of Ease.

Upon finishing the reconciliation and tax form preparation, we’ll hand over your detailed tax reports.

These reports serve as your reliable record-keeping companions, offering a sense of security, especially in the event of an audit.

They provide a comprehensive overview of your cryptocurrency transactions for the tax year.

Our mission is to make the process of preparing and filing your cryptocurrency taxes as straightforward and hassle-free as can be.

Navigating the Evolving Cryptocurrency Tax Landscape

Ahead of the Crypto Tax Curve

We take pride in our commitment to staying at the forefront of the ever-evolving crypto tax landscape. We understand that cryptocurrency tax policies and regulations can change rapidly, causing confusion and uncertainty for individuals and businesses. That’s why we make it our priority to remain up-to-date with the latest developments.

Our team closely monitors tax policy changes, keeping a keen eye on shifting regulations and emerging guidelines. By staying informed and proactive, we ensure that our clients receive the most accurate and current advice, helping them navigate the complex world of crypto taxes with confidence and ease.

Start simplifying your crypto tax preparation today!

Schedule a consultation with one of our crypto tax professionals.