We Do Your Crypto Taxes For You.

No more tax software hassles or compliance headaches. We remove all the stress and uncertainty caused by constantly changing crypto tax regulations and complex calculations and get your crypto taxes completed. Choose ease and efficiency with us!

Featured On:

When high transaction amounts and complex tax scenarios become the norm, it’s no surprise that even renowned crypto tax software companies feature our service. We’re the go-to choice for handling intricate crypto tax matters, and our expertise is valued by these industry leaders.

Remove The Complexity and Stress From Crypto Taxes

This is the future of cryptocurrency tax prep. We make compliance easy, saving you time with our user-friendly and accurate service.

- Time Savings: Save valuable time with our done-for-you service, eliminating the endless hours spent on entering hundreds or thousands of entries on a tax form.

- Effortless Compliance: Simplify cryptocurrency tax regulation compliance in the face of evolving tax laws.

- Maximized Return: We customize tax strategies to optimize your returns based on your crypto portfolio and financial situation, ensuring every opportunity for maximum return is utilized.

The Challenge

Balancing Compliance and Efficiency:

Managing cryptocurrency taxes is a daunting task.

Every trade on every currency pair, staking rewards, air drops, mining, and many more crypto related actions are all taxable events.

Assigning a U.S. dollar amount at the specific date and time of each event is essential in order to get the maximum return on your taxes and to remain in good standing with the IRS.

While crypto tax software may allow for effective data importing, it’s the time-consuming and manual calculations that often prove to be a major hurdle, making it challenging to find accurate cost basis and capital gains efficiently.

The complexities of cryptocurrency taxation, constant changes in regulations, and the sheer volume of transactions across various platforms can overwhelm even the most seasoned accountants.

The Solution

We Are Crypto Accountants

Our team of crypto accountants are hyper focused on staying up to date with every tax nuance, laws, and the latest crypto trends. We guarantee our accuracy and will ensure you only pay taxes on what the IRS deems a taxable event, nothing more.

Automated Transaction Tracking with a Human Touch

Send us your information anonymously and we seamlessly assemble your transaction history. Then, our tax professionals review each return for maximum accuracy. Say goodbye to the tedious, error-prone task of manual entry that other software often necessitates.

Effortlessly Generate IRS Crypto Tax Forms

Our service harnesses cutting-edge automation to simplify tax calculations for everyone. From those dealing with high-volume cryptocurrency transactions to the NFT enthusiast. Unlike traditional crypto tax software, our service streamlines the process, saving you time while ensuring precise tax forms.

Gain In-Depth Insights

Make informed decisions about your crypto tax obligations with access to actionable insights and reporting.

Your USA Crypto Tax Forms Completed In 4 Easy Steps

Collect Information

We securely gather information from you directly or indirectly, based upon your communication preferences.

Prepare Crypto Tax Forms

You'll be assigned a dedicated tax professional who will guide you through our process. They will prepare Form 8949 and Schedule 1 (Form 1040)

Deliver Tax Reports

We provide you with a copy of the detailed tax reports for your records for quality assurance, in case of an audit.

Produce Tax Planning Reports

We provide optional realized and unrealized reports in November for year-end tax planning.

Import From Any Platform. We'll Handle The Rest.

Every wallet and exchange is supported for your convenience.

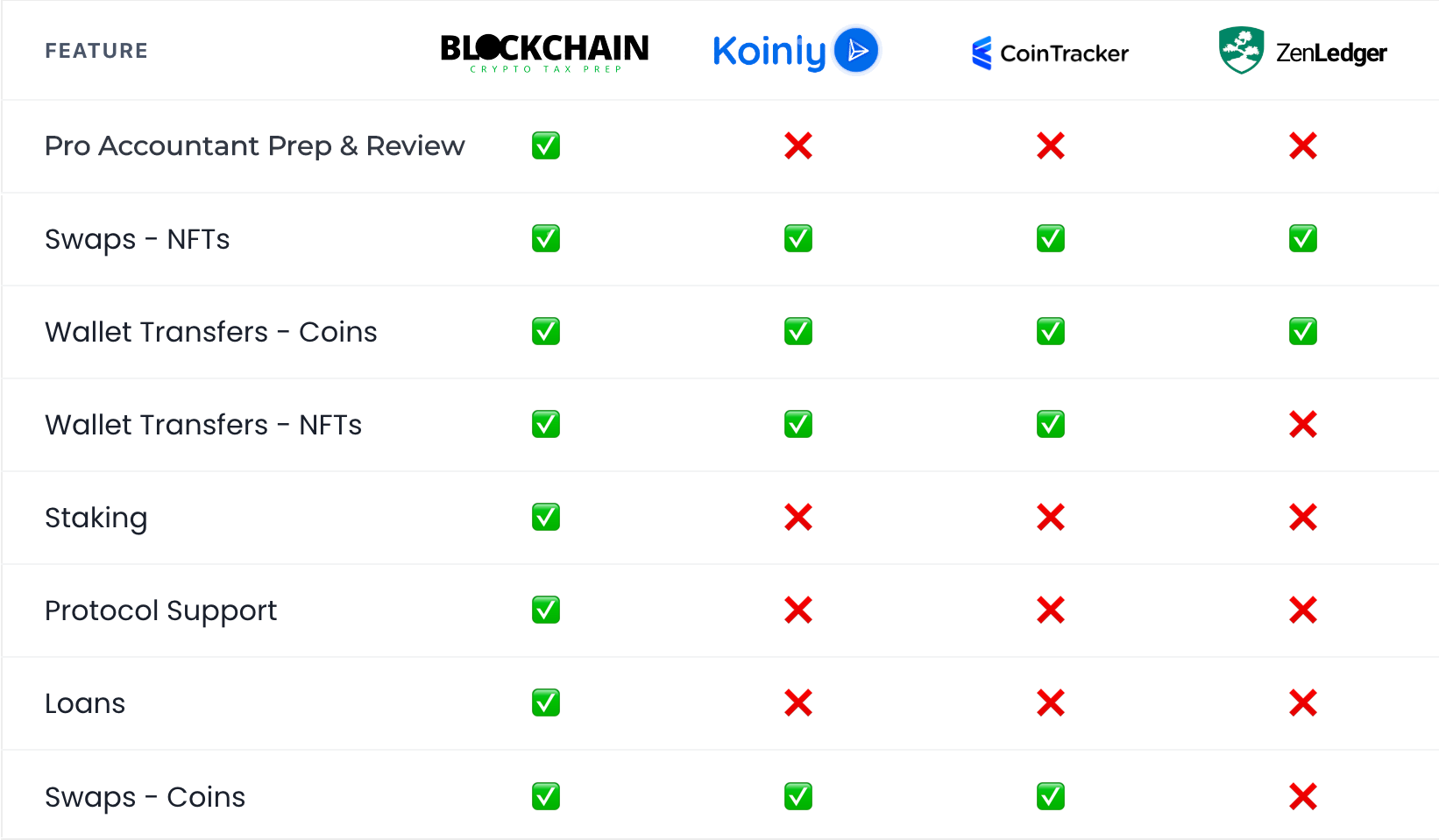

The Most Comprehensive Approach

To Crypto Taxes

How We Compare To Tax Software

Lead By Industry Experts

Pioneering the cryptocurrency tax frontier with a wealth of expertise and visionary leadership, Mike Ring and Brian Ernest, co-founders of Blockchain Crypto Tax Prep, collectively bring over a decade of public accounting, corporate finance, and entrepreneurial experience, culminating in their commitment to setting a new industry standard for excellence and growth. Fueled by profound passion and dedication, Blockchain Crypto Tax Prep is not just a service but a fusion of their diverse backgrounds, innovative spirit, and a shared commitment to providing unparalleled crypto tax solutions. Read More About Us!

Introducing Privacy Shield: Your Privacy, Our Priority

We understand the importance of safeguarding your privacy, which is why we’ve introduced Privacy Shield. It ensures anonymity and security throughout your crypto tax journey:

No Keys, Logins, or Wallet Links: We never request access to your private keys, logins, or wallet links, respecting your autonomy.

No Personal Information Needed: Your name, social security number, or any personally identifiable information is not required.

KYC-Free Experience: Our platform eliminates invasive Know Your Customer (KYC) procedures, ensuring your privacy remains intact.

With Privacy Shield, you get a confidential and secure crypto tax experience. Your data stays anonymous, and your privacy is our top priority.

Why Our Customers Love Us

Building a dedicated following one Fan at a time

I had a lot going on with my crypto; I used multiple exchanges and was heavily into defi, hot and cold wallets, multiple staking protocols, lending pools, earn programs, etc. And I had a couple of unique situations that I was nervous even bringing up, thinking he might say that’s a bit much or we handle the basics, but he took all my worries away that night. I put myself through countless hours (dozens, many dozens) of stressful-filled hell trying to straighten out my crypto taxes. I wasted hundreds of dollars on worthless automated software programs that outright lied about what they offered in terms of support and the capabilities of their software. If you need help with your crypto taxes, and trust me, if you are doing them yourself, “DON’T.” You need help to keep up with all the tax laws and changes. And don’t count on these crypto tax software plans; sure, you might get your form 8949 and think life is great until you realize they have yet to update the software for the last 3, 6, 9 months, or more. The crypto landscape is changing rapidly, and I’m telling you, those software programs are not the answer.

At Blockchain Crypto Tax Prep, you deal with real professionals; these guys and gals (and pronouns) know this industry. They know the crypto tax laws and regulations; it’s what they do, it’s not a hobby, it’s their profession, and every client either builds or breaks their reputation, and all I could find was one hell of a solidly built reputation. Call Brian and let him put your mind at ease like he did for me. Thanks to Brian and his team, I can finally begin to enjoy all my hard work over the past 4 or 5 years. I try not to live with regrets as it accomplishes nothing, so instead of complaining about not finding or wishing I had found Brian and Blockchain Crypto Tax Prep sooner, I will express my gratitude for having found them when I did. Thank you, Brian and everyone at Blockchain Crypto Tax Prep. You have earned a customer for years to come.

Sincerely,

Howard Grant Platt III

Simplify your crypto tax preparation and accounting today!